Important notice – Canada Post strike – For any assistance, please contact us at 1-866-338-5126.

Reminder: You can access your policy and file at any time through Assurancia Groupe Tardif’s Client Access or Intact’s Client Centre.

To benefit from the best protection, take the time to study the different options of your auto insurance contract.

In addition to third-party liability, which is mandatory, options are available to protect damage caused to your vehicle (collision, theft, fire, etc.) or for specific needs (replacement insurance, etc.).

To have solid protection adapted to your needs, ask your questions to your broker:

Your automobile insurance broker is there to assist you.

Excellent customer service, thank you Claudie Proulx.

Sylvain C (Google Review)

Succursale de Gatineau

Service that meets my expectations with respect and courtesy.

Gilles T (Google Review)

Succursale de Gatineau

Very good service and competent broker.

Nicolas M (Google Review)

Succursale de Quebec

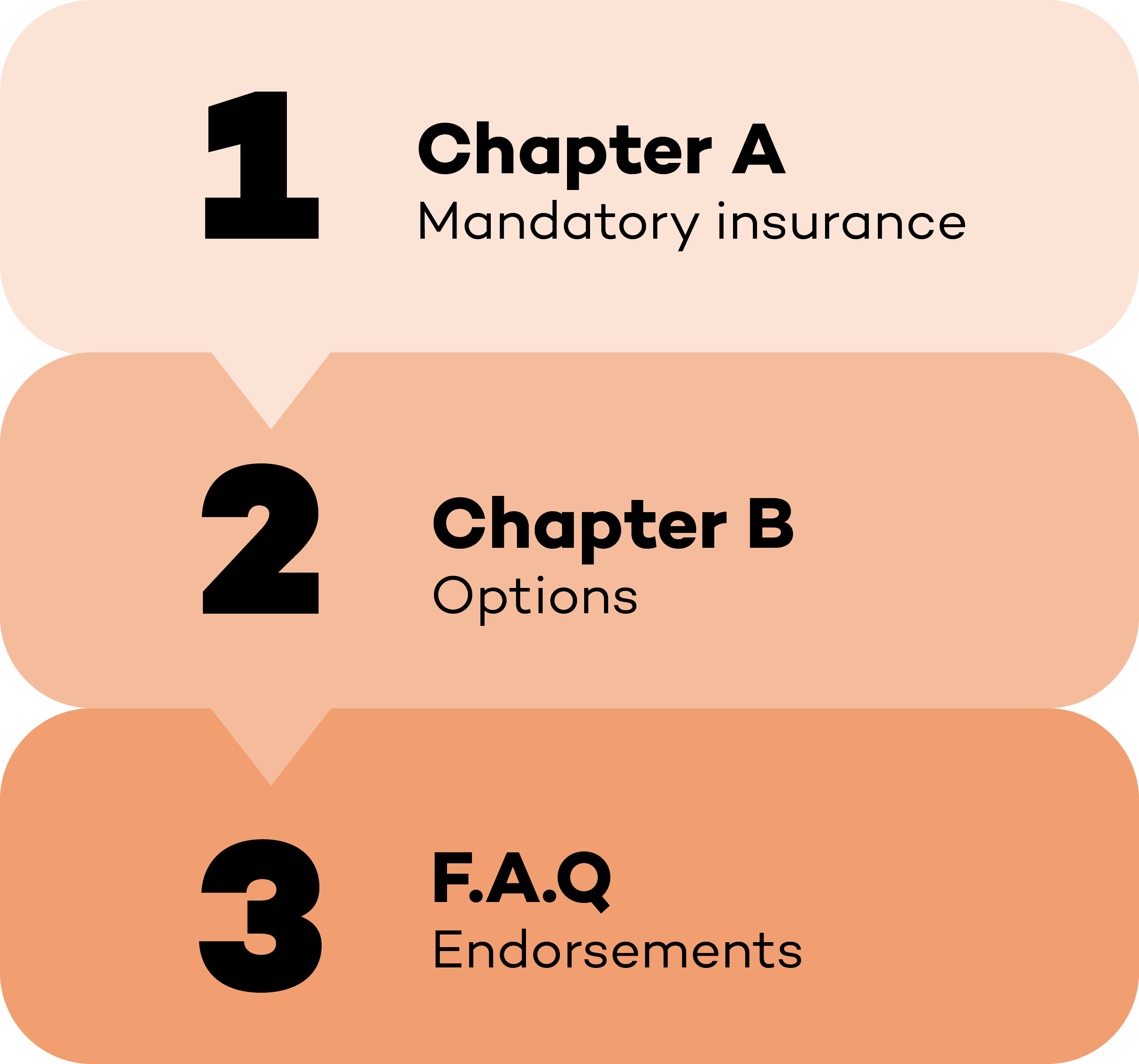

The car insurance contract is standard between all insurers so that it is understandable by all insured. It is organized into three parts:

Part 1 called “Chapter A”: covers civil liability insurance (mandatory insurance). In this chapter, you will find the amount of your civil liability.

Part 2 called “Chapter B”: includes the different options for damage to your vehicle (collision, fire, theft, vandalism, glass breakage, etc.).

Part 3 called “F.A.Q” (Quebec Endorsements Form): includes endorsements, and additional protections (replacement insurance, etc.).

Your automobile insurance broker is there to advise you and help you understand your contract

Contact your broker to find out about all the discounts available.

By bundling auto and home insurance, you save money.

Discount when you insure more than one vehicle belonging to members of the same family/same household.

Does your organization have a group plan with Intact? You are eligible for the rate negotiated by your organization.

Drive an electric vehicle and obtain a discount on your auto insurance

For your broker to be able to make the most accurate quote possible, you must provide him with the following information:

Year, make, model, estimated annual mileage, date of purchase/lease of the vehicle, number and description of violations and claims....

First and last name, address, driver's license number, year of license, etc.

With your agreement, we will question the credit agency to be able to make you the best possible offer. Be aware that this does not affect your credit rating.

Do you really know what to do in the event of a car accident? Do you know when to contact your insurance provider? Do you know what information to provide?

To help you avoid stress and panic, we've created this anti-stress checklist explaining the 4 essential steps to follow in the event of a car accident in Quebec.

DOWNLOAD THE CHECKLIST

Trust us, Assurancia Groupe Tardif specializes in second chance insurance and has a team dedicated to finding solutions for you!

Non-payment of premiums

Criminal record

Claims frequency

Interrupted insurance contract

Employment related issues

Difficult financial circumstances, including discharged bankruptcy

And many more…

Insurance premium: amount to be paid to be covered by the insurer for the duration of the contract.

Insurance policy: a contract (policy) in which an insurer indemnifies another against losses from specific perils

Deductible: It’s an amount you must pay in the event of a claim. In certain situation the deductible will not apply.

Certificate of insurance: It’s a proof of insurance to have in your possession. (known as a pink card).

The public plan of the Société de l’assurance automobile du Québec (SAAQ) covers bodily injury.

Private insurance covers material damage caused or suffered by the insured and bodily injury caused to another person that is not covered by the SAAQ.